how are property taxes calculated in orange county florida

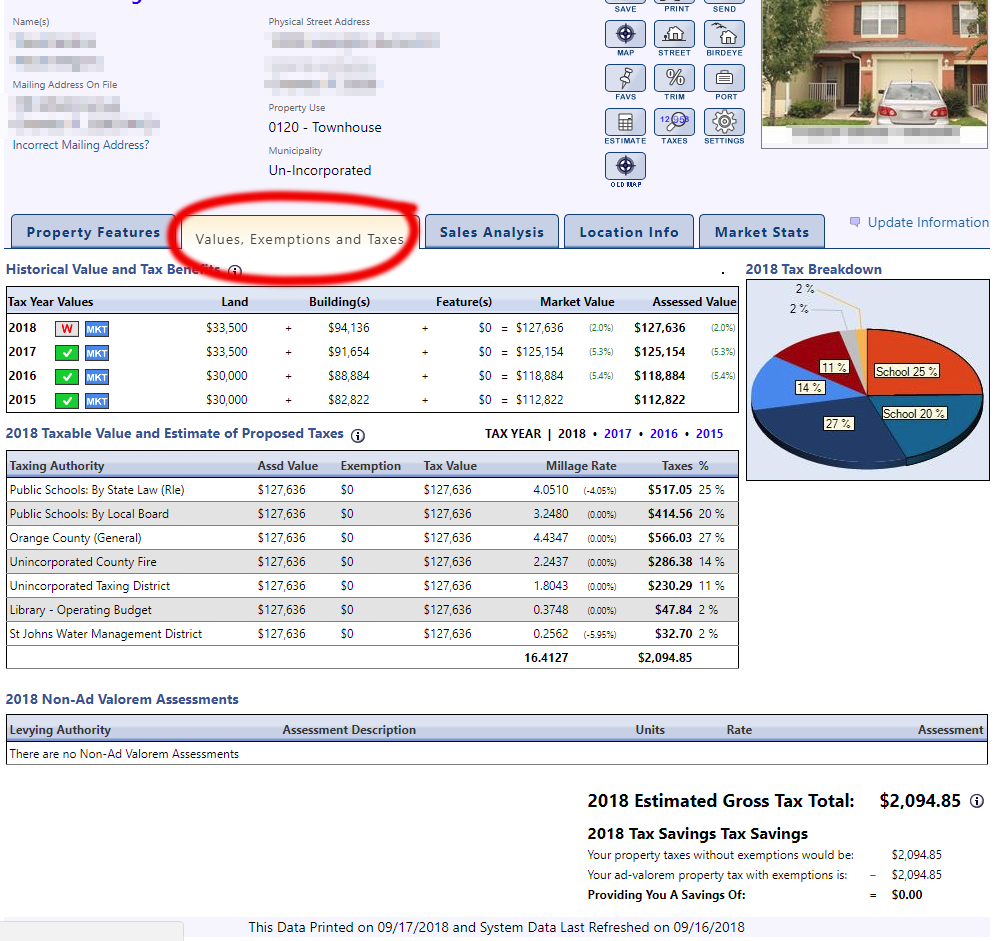

Key in the Parcel Number OR Property Address below and Click on the corresponding Find button. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would.

Factors That Help Determine Property Value Florida Home Property Values Helpful

That leaves one avenue.

. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value. This office is also responsible for the sale of property subject to. Homes now are selling in record time and at higher than the appraised.

The median property tax on a 22860000 house is 221742 in Florida. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The present market worth of real property situated in your city is determined by Orange County appraisers.

The full amount of taxes owed is due by March 31. The Property Appraisers Office also determines exemptions for Homestead Disability Widows Veterans and many others. Download a Full Property Report with Tax Assessment Values More.

Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. Once again Florida has mandated statutory rules and regulations which county. Search Any Address 2.

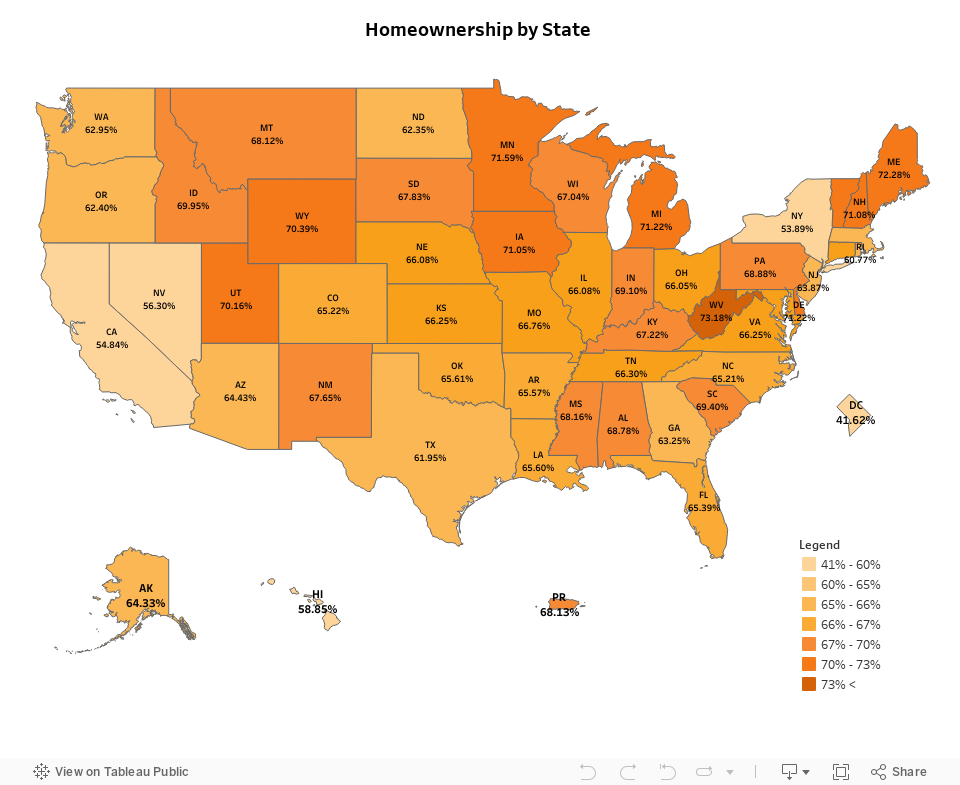

The Orange County Florida sales tax is 650 consisting of 600 Florida state sales tax and 050 Orange County local sales taxesThe local sales tax consists of a 050 county sales. Ad View County Assessor Records Online to Find the Property Taxes on Any Address. 68 rows The average Florida homeowner pays 1752 each year in real property taxes although that.

Then the next 25000 the assessed value. I dont see how Orange County doesnt raise property taxes by 20. Post Office Box 38.

The Property Appraiser determines the ownership mailing address legal description and value of property in Orange County. How Are Property Taxes Calculated In Polk County Florida. Taxes are calculated by multiplying the property value less exemptions by the millage rate which is determined by local taxing.

Property taxes of which Orange County collects approximately 600 million per year right now. The median property tax also known as real estate tax in Orange County is 215200 per year based on a median home value of 22860000 and a median effective property tax rate of. Review and pay your property taxes online by eCheck using your bank account no cost or a credit card 229 convenience fee with a minimum charge of.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. Orange County calculates the property tax due based on the fair market value of the home or property in question as determined by the Orange County Property Tax Assessor. In 2019 the median home in Orange County sold for 329589.

The next 25000 the assessed value between 25000 and 50000 is subject to taxes. The following early payment discounts are. Pay Your Property Taxes Online.

Opry Mills Breakfast Restaurants. Do not enter street types eg. The first 25000 would be exempt from all property taxes.

The primary figure used to calculate support is the income of both parents. Select East West South North Southeast. The median property tax on a 22860000 house is 214884 in Orange County.

Its Fast Easy. Street Number 0-999999 or Blank. Documentary stamp taxes also known as doc stamps or excise taxes are taxes imposed by Florida law on transactions involving the transfer of ownership or interest in real estate.

The median property tax on a 22860000 house is 240030 in the United States. This Supplemental Tax Estimator is provided for you to. The median home value in Santa Ana the county seat in Orange County is 455300 and the median property tax.

City of Orlando Property Tax Search Calculator. See Property Records Tax Titles Owner Info More. Street Number 0-999999 or Blank East North North East North West South South East South West West.

The Orange County Tax Collector collects business taxes under Florida Statute Chapter 205 and. Restaurants In Erie County Lawsuit. Office of the Clerk of the Board.

Orange County Property Tax Rates Photo credit. In 2020 the home price rose to 360325. Tangible Personal Property Taxes are mailed to property owners by November 1 of each year.

A Closer Look The Office Of The Orange County Property Appraiser

Orange County Ca Property Tax Calculator Smartasset

Orange County Property Tax Oc Tax Collector Tax Specialists

Chapter 13 Bankruptcy Keep Your Property Repay Debts Over Time By Cara O Neill Attorney Nolo Bankruptcy Chapter 13 Tax Debt

Orange County Ca Property Tax Calculator Smartasset

Property Tax Orange County Tax Collector

California S 50 Safest Cities Of 2022 Safewise

Registration Tag Renewals Orange County Tax Collector

Florida Property Taxes Explained

Florida Property Tax H R Block

O C Tax Roll Tops 500 Billion Orange County Register

Estimating Florida Property Taxes For Canadians Bluehome Property Management

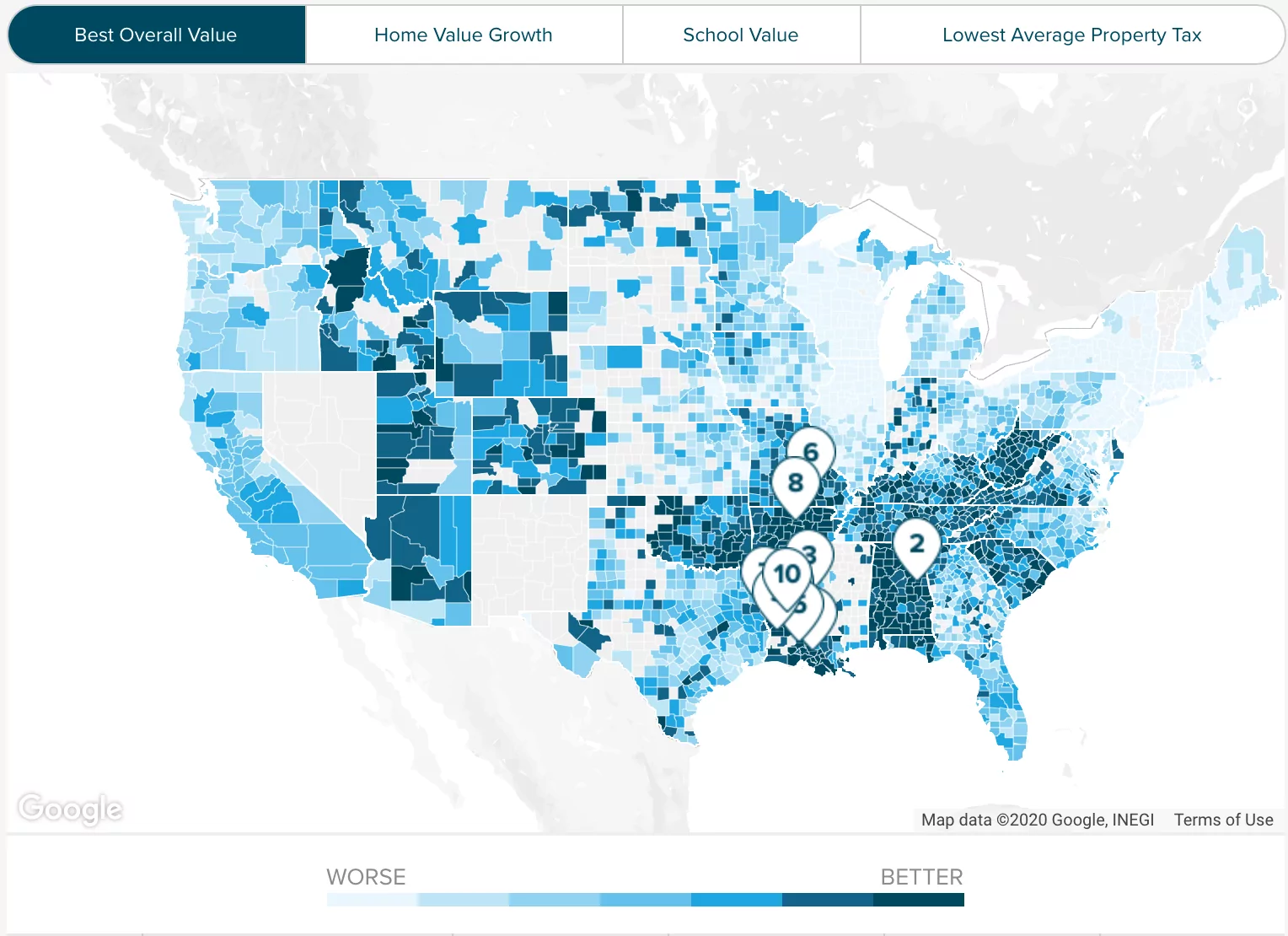

Property Taxes By State Propertyshark

Orange County Property Tax Getjerry Com

Home Buying Process Flowchart Selling Home Tips Ideas Of Selling Home Tips Sellinghometips Sellhometips Home Buying Process Home Buying Buying First Home

Oc Tax Collector Octaxcol Twitter

Homeowners Can Save 4 On Their Property Tax Bill By Paying In November Orange County Tax Collector