how does doordash report to irs

Because drivers will owe taxes from their profits from dashing a smart move would be to set aside about 30 percent of earnings in a bank account to prepare for paying taxes. Grubhub Uber Eats Doordash Instacart and others report our earnings to the IRS through a 1099 form.

Prepare For Tax Season With These Restaurant Tax Tips

Typically withholding around 30 of your income is a safe number.

. Once you receive the 1099 form and file the taxes you need to report the exact figure as the overall income to the IRS. The subject line to look out for is Confirm your tax information with DoorDash Stripe gives you the option to receive your 1099 by either e-delivery or snail mail. You should report your income immediately if they do not send you a 1099.

Does DoorDash report to IRS. What you just said amounts to tax evasionwhether you receive a 1099 or not ALL income is required to be reported for the previous tax year. -2 level 2 bigblard 1y Tax evasion is illegal.

Dashers are not required to report their income at the end of the year. DoorDash 1099s Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. If you earned 600 or more you should have received an email invitation in early january the subject of the email is confirm your tax information with doordash from stripe to set up a stripe express account if you did not receive the email invitation but earned 600 or more in 2021 on doordash please contact stripe express support by.

3 Continue this thread. Incentive payments and driver referral payments. It will let you see your 1099 online by January 31.

DoorDash EIN The Federal Tax ID Number or Employer Identification Number EIN for DoorDash is 46-2852392. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation. Internal Revenue Service IRS and if required state tax.

Dont make that mistake. The 1099 forms are issued to independent contractors like drivers of DoorDash and freelancers. DoorDash uses Stripe to process their payments and tax returns.

If Dashing is a small portion of your income you may be. Doordash will send you a 1099-NEC form to report income you made working with the company. A 1099 form differs from a W-2 which is the standard form issued to employees.

The IRS required DoorDash to send form 1099-NEC instead of 1099-MISC beginning in the 2020 tax year. Doordash will send an email to you to have you confirm your delivery information with Stripe the company that processes direct deposits to your financial institution and that processes 1099 forms for Doordash. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

DoorDash typically manages 1099 delivery drivers. DoorDash can be used as proof of income DoorDash usually sends a 1099 to its drivers to keep track of their earnings to the IRS. E-delivery is the faster option.

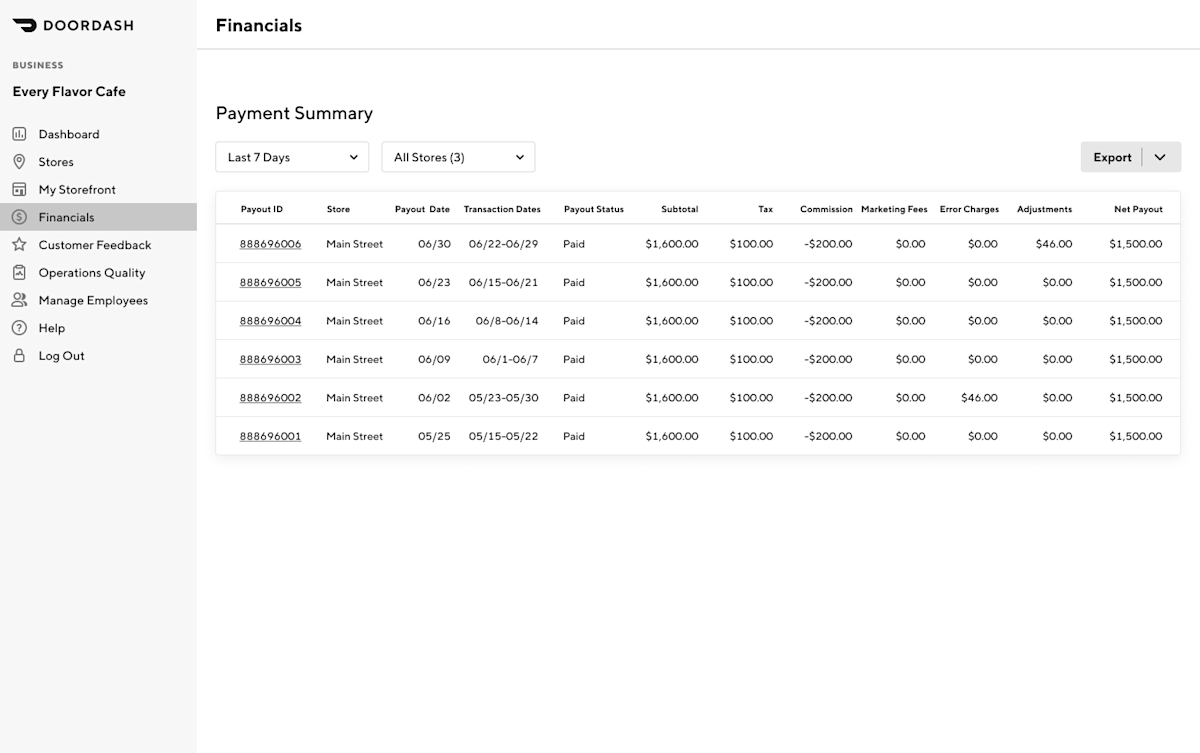

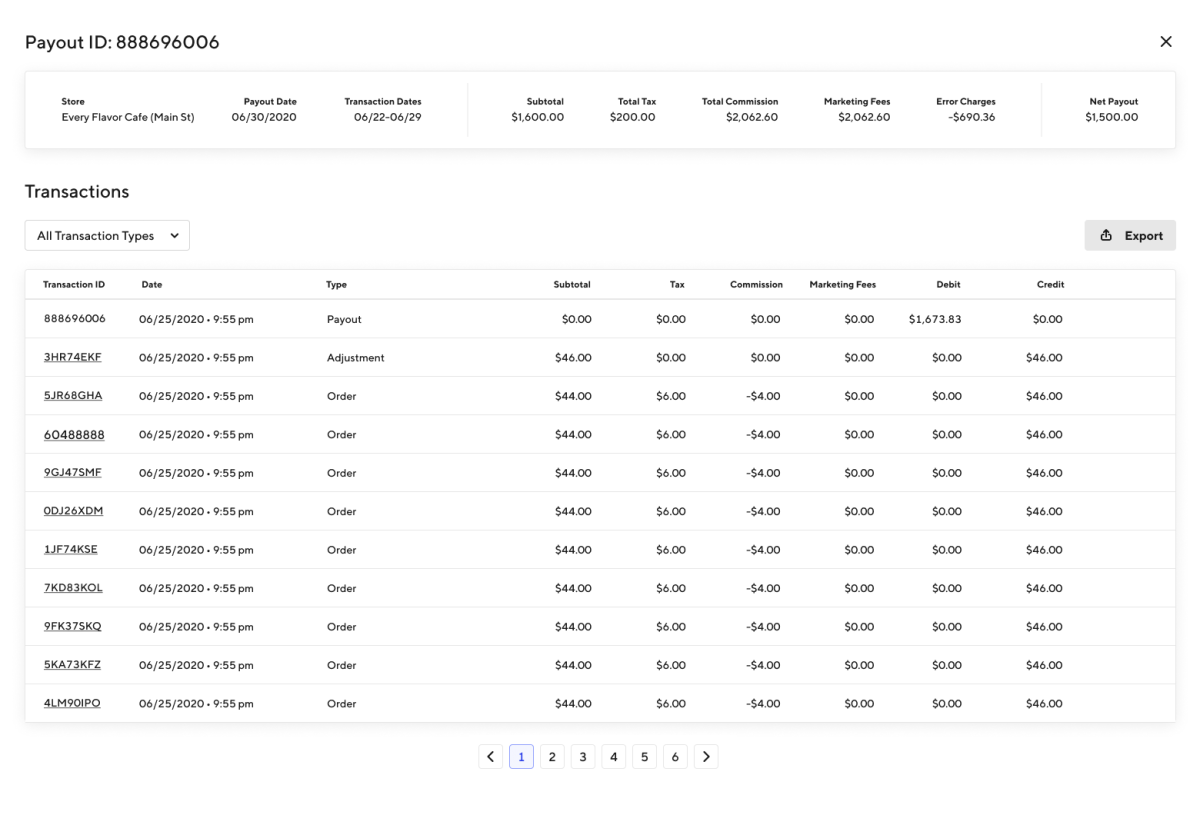

No taxes are taken out of your DoorDash paycheck. January 31 -- Send 1099 form to recipients February 28 -- Mail 1099-K forms to the IRS OR March 31 -- E-File 1099-K forms with the IRS via FIRE If your store is on Marketplace Facilitator DoorDash collects and remits sales tax on your stores behalf. You will be responsible for paying taxes on any income earned through Doordash including self-employment tax.

But if filing electronically the deadline is March 31st. The requirement to receive this form is if you earned more than 600 in the tax year for your services youâll be sent a 1099-NEC form. For more information on Marketplace Facilitator please visit our FAQ here.

As such it looks a little different. Its YOUR job to track your earnings. DoorDash dashers who earned more than 600 in the previous calendar year will receive a 1099-NEC form through their partner Strip.

This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes. Like most gig jobs Doordash does not take any out or withhold any money for your taxes. It sends it out regularly to them but anyone who hasnt yet received it can request it.

Tough to decipher the exact question youre asking but. If you choose snail mail your form will also be mailed out on the last day of January. While DoorDash doesnt send its drivers W-2 tax forms it does send them 1099-NEC forms and reports drivers income to the IRS.

Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly. In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC. The employer typically sends 1099 forms to you and the IRS in February.

Form 1099-NEC reports income you received directly from DoorDash ex. Before I go further. How does DoorDash report to IRS.

This is typical for businesses paying people as independent contractors. Youll get a form from Doordashs partners Stripe and Payable. How does DoorDash report to IRS.

How Do Food Delivery Couriers Pay Taxes Get It Back Does Doordash Track Miles How Mileage Tracking Works For Dashers Doordash 1099 Critical Doordash Tax Information For 2022. How does doordash report to irs Sunday July 24 2022 Edit. A lot of people get the idea that Doordash is under the table work or that Grubhub income can go without being reported.

Tax avoidance is every Americans patriotic duty. How Do I Apply For Unemployment Benefits With DoorDash.

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Prepare For Tax Season With These Restaurant Tax Tips

Santander Collections Reported Cfpb Complaint How To Diy Credit Repair Dispute Letters Tutorial Credit Repair Lettering Tutorial Dispute Credit Report

Prepare For Tax Season With These Restaurant Tax Tips

How Do Food Delivery Couriers Pay Taxes Get It Back

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

A Beginner S Guide To Filing Doordash Taxes 4 Steps

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash Data Breach 5 Things To Do If You Were Affected

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

4 Ways To Report A Website Wikihow

How Do Food Delivery Couriers Pay Taxes Get It Back

Deliver Your 1099 Tax Forms Stripe Documentation

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Does Doordash Track Miles How Mileage Tracking Works For Dashers

Form 1099 Nec For Nonemployee Compensation H R Block

Mileage Report What S Required How Falcon Expenses Can Help Mileage Tracking Mileage Expensive

How Do Food Delivery Couriers Pay Taxes Get It Back

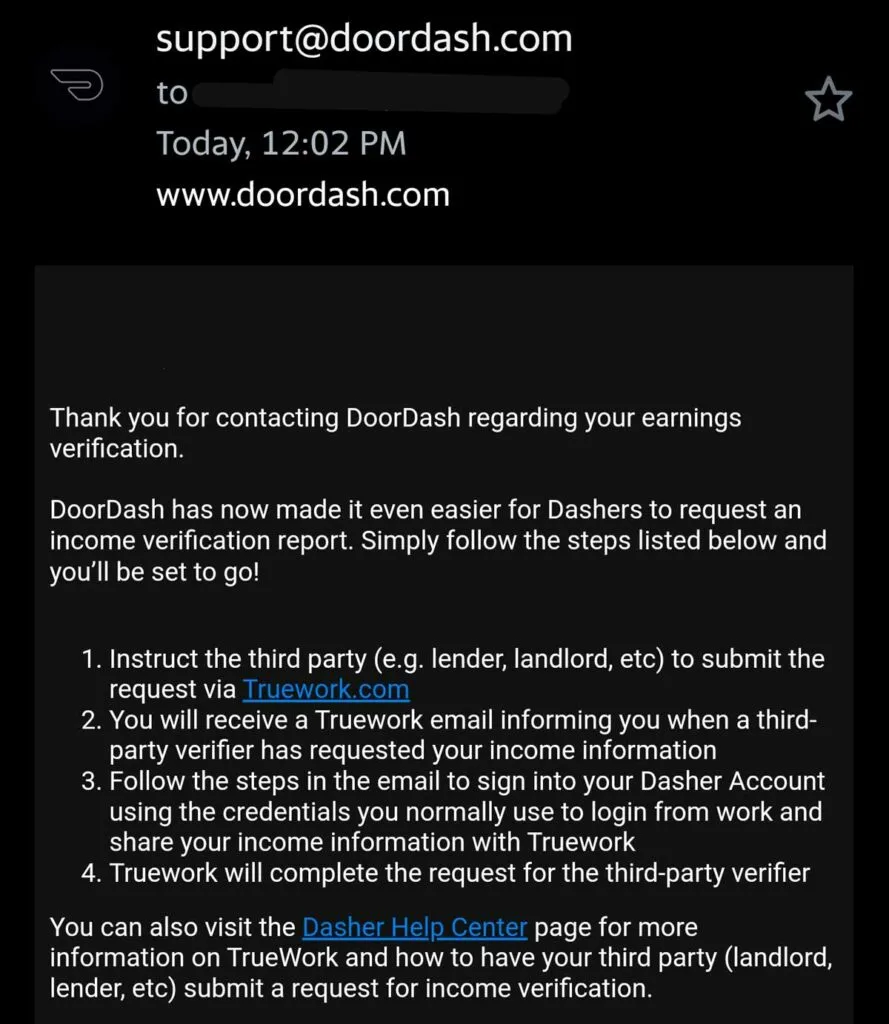

How To Get Your Doordash Pay Stubs And Earnings Statement Employment Verification